SPECIAL FEATURE

The Indian Trust Fund

Debunking Myths and Misconceptions

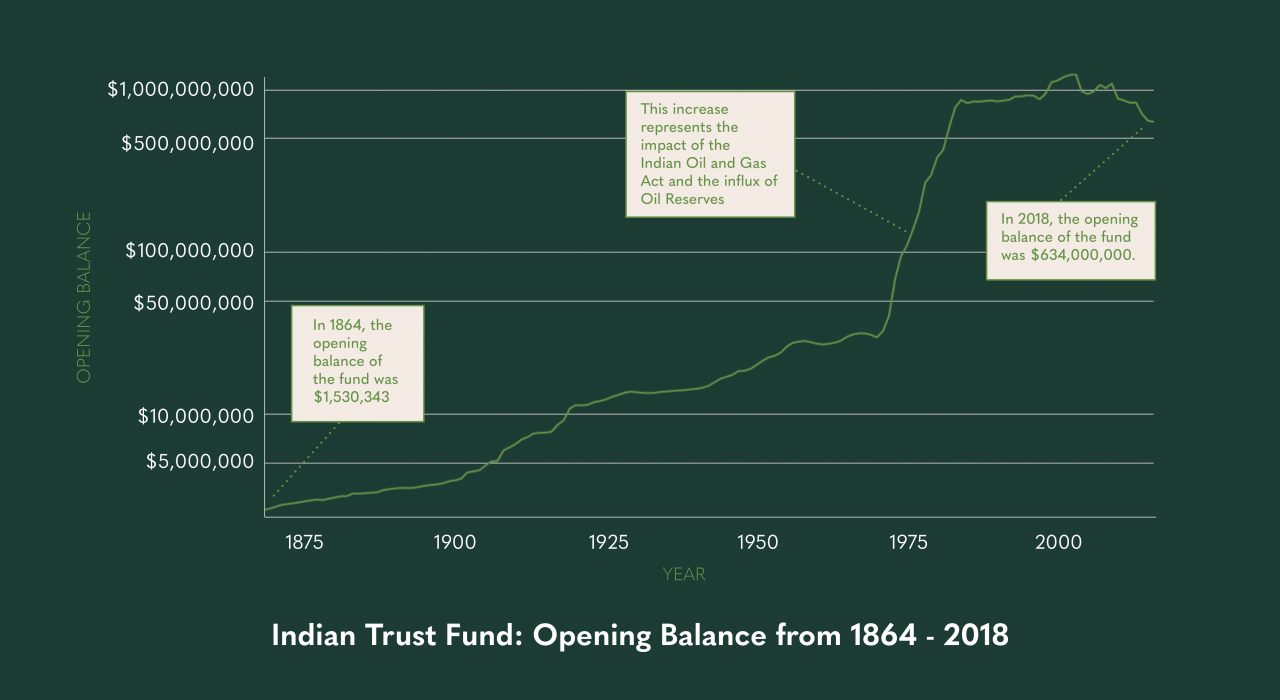

The Indian Trust Fund is an account that holds all the moneys collected, received, or held by the Crown for the “use and benefit” of First Nations.

There is significant confusion, mythology and a lack of clarity around this fund. Until the 1860s, trust funds and the lands and resources that made them grow were managed by a large set of institutions, both in the colonies and imperial Britain, guaranteeing confusion and inefficiency as well as encouraging fraud.1

Later on, the establishment of the Fund to its eventual absorption into the Consolidated Revenue Fund (CRF), the recording and transactions of the funds were haphazard. Much like many fiscal policies relating to First Nations, depending on the time and the bureaucrats in charge, record-keeping could be minimal and subject to miscalculations and theft. Here, we shed light on some of the key questions related to Indian Trust Fund.

The Basics

What happened in 1951?

In 1951, an amendment to the Indian Act Amendment and Financial Administration Act moved the Indian Fund to the Consolidated Revenue Fund. This meant that the funds were no longer held separate from Canadian funds. This shift happened at the same time as new status and registration rules, increasing Canada's control over First Nation governance and moneys, and erasing reference to Treaty. Funds became connected to Indian status and band membership instead of to descendants of Treaty signatories.

The Cash

The Relationship

Indian Trust Fund research was conducted primarily by Robert Houle (Wapsewsipi - Swan River First Nation, Treaty 8). For citations, please download the PDF of these FAQS.